Images by GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways When you prepay your mortgage, you pay extra toward the loan principal. This helps you pay your loan off sooner and save money on interest. There are many ways to prepay a mortgage, including through biweekly payments, periodic extra payments or…

While the top ten largest credit unions still hold significantly less in assets than even the top five largest banks, they have been growing considerably in recent years. Just within 5 ½ years, total assets in federally insured credit unions have risen by over 46%, increasing from $1.64 trillion in…

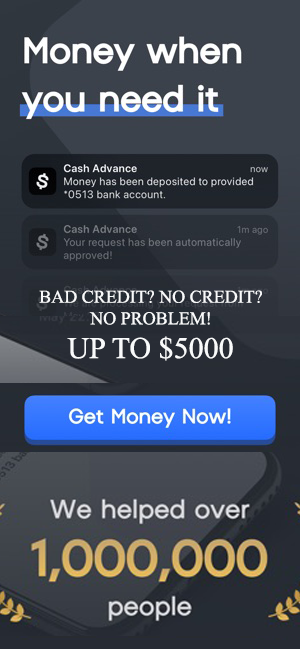

Images by GettyImages; Illustration by Jessa Lizama/Bankrate Key takeaways Lower credit scores signal higher risk of default to lenders, so lenders will limit loan amounts. Borrowers with bad credit get approved for unsecured loans with an average amount under $2,000, according to TransUnion data. Adding a cosigner or co-borrower with…

While adding a child to a deed may seem straightforward, the tax implications can be complex and long-lasting. Depending on how you structure the transfer, it may affect gift taxes, capital gains taxes, and future estate planning outcomes. State laws and ownership structures can also influence the results. A financial…

Spotlight This Week

More ArticlesPersonal Finance

Last year, on the day before Tax Day, my mom was scheduled to fly into Philadelphia International Airport to stay…

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

With Republicans ending the Grad Plus program, private lenders are eyeing billions in new business, while some students could be…

Featured Articles

Once you retire, the purpose of your investment portfolio often changes. Instead of concentrating primarily on growth, many retirees focus on generating reliable income to supplement Social Security, pensions or other sources of income. Choosing the right investments to add income after retiring can help…

Dept Managmnt

Does a Consumer Proposal Affect My Credit Score? Yes, filing a consumer proposal will affect your credit score. Your score reflects your past…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

Sixty percent of Americans under age 65 — that’s about 164.7 million people — receive their health insurance through their employer, according to a Kaiser Family Foundation analysis. That means losing a job can feel like a one-two punch: the loss of both income and health insurance. Then comes the…

Survey: 2 In 5 Americans In A Relationship Have Kept A Financial Secret From Their Partner

Would you be upset if you found out your partner had a credit card you didn’t know about? On the flip side, have you ever fudged the numbers with your spouse about a recent shopping spree? Romantic relationships can come with mixed feelings about money. That’s why we asked more…

Key takeaways An emergency fund helps ensure you can handle unplanned expenses, whether from a job loss or a substantial car repair or medical bill. Saving three to six months’ worth of essential expenses is often recommended, but individual circumstances may require saving more or less. Automating savings and using…

VIEW press/Contributor/Getty Images Wells Fargo is a financial institution that offers its customers personal, small business, commercial, corporate and investment banking solutions. There are currently around 5,600 branches and 11,000 ATMs nationwide. Wells Fargo Bank near me You can find a Wells Fargo retail banking branch near you by using…

Key takeaways Mobile banking alerts detect fraud faster than manual monitoring. The sooner you report unauthorized activity, the greater your chance of full reimbursement under federal law. Low balance alerts help you avoid overdraft fees, which average $26.77 per transaction in 2025, according to Bankrate’s checking account survey. Essential alerts…

You’ve heard of home equity lines of credit (HELOCs) and home equity loans, which let you borrow against the value of your home, getting ready cash for renovations, debt consolidation or anything else. But jumping through the income-qualification hoops that characterize much home-based financing may be difficult for borrowers with…

Key takeaways The NCUA (National Credit Union Administration) insures credit union deposits up to $250,000 per depositor, per institution, per ownership category. NCUA insurance provides the same protection as FDIC insurance at banks. Both are backed by the full faith and credit of the U.S. government. Joint accounts receive $250,000…

Key takeaways CD early withdrawal penalties typically cost 60 to 365 days of interest, with longer terms carrying steeper penalties. Breaking a CD early may be worth it if you need funds to avoid high-interest debt, make a major down payment, or lock in significantly higher rates. CD early withdrawal…

Key takeaways Your credit card APR can go up if the prime rate changes, you paid your credit card bill late, your intro APR offer ended or your credit score dropped. If your APR increases, you can work on paying down your balance or transfer your balance to a card…

Key takeaways The ongoing impact of inflation in recent years has left many Americans tightening their wallets. One surprising solution for combating the negative impacts of high prices may be opening a new credit card that allows you to offset higher costs with cash back savings and other rewards. But…

Editor's Pick