Illustration by Hunter Newton/Bankrate

You’ve lost your job. Who are you going to call?

It might have to be your mortgage lender.

A cooling job market is colliding with high homeownership costs, putting many people into a particular new squeeze: a loss of income and a monthly payment that was already hard to manage. At the same time, 42% of homeowners report expensive hidden costs and 16% say their mortgage payment is too high in Bankrate’s 2025 Home Affordability Report. Bankrate talked to recently laid off homeowners to find out how they’re dealing with it.

“I was definitely stressed out,” says Taylor Brione Ballard, 33, who lost her job at a nonprofit only a month after locking in a new mortgage.

“I did take some time to cry, and then I had to get my big girl pants on.”

We also talked to mortgage professionals who recommended a number of potential options, especially for those who get in touch directly with their loan servicer.

If you lose your job, call your lender right away

You should contact your mortgage servicer as soon as you anticipate financial hardship, says Hala Garmo, regional mortgage manager for U.S. Bank. They can help you come up with a plan — after all, they have a financial incentive to keep you paying your mortgage.

Your mortgage servicer may not be the same lender you applied with to get your mortgage. It’s common for lenders to sell servicing rights, which means you’ll start paying your mortgage to a different company. If that’s happened to you, you’ll want to reach out to your servicer — who you make your monthly payment to — for assistance.

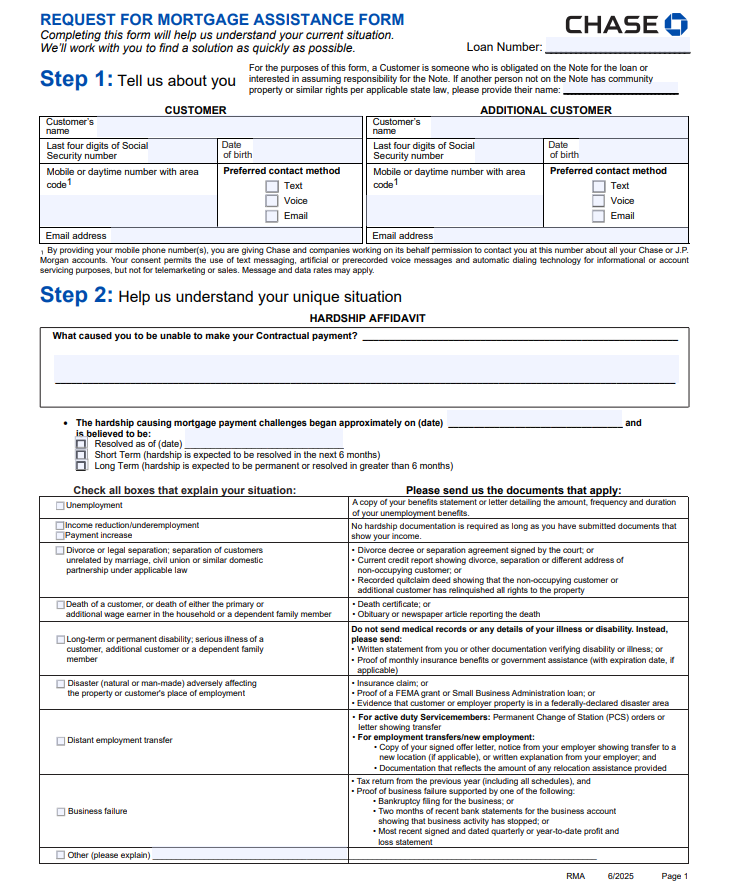

You’ll likely need to submit a request for mortgage assistance (RMA). This is a form that asks for your information, including the hardship you’re facing.

“Once we get that RMA, that’ll get the wheel in motion,” says Becky Griffin, head of home lending servicing for Chase Home Lending. A relationship manager would then be assigned to discuss options.

Check out an example of an RMA on Chase’s website.

Ballard called her lender right after getting laid off. They gave her a 15-day grace period on payments with no late fee or credit reporting.

She also filed for unemployment, ramped up her side hustle, withdrew money from her 401(k), tapped into her savings and eventually took on $15,000 in credit card debt to pay her bills, including her mortgage.

It’s not just you — the job market is tough

If you’ve been laid off, you’re not alone. That can feel both reassuring and frustrating, as open roles now have more competition. October 2025 had the highest October job cut total since 2003, according to a recent report from executive coaching firm Challenger, Gray & Christmas. This is up 175% year-over-year.

“Job creation is pretty close to zero,” said Fed Chair Jerome Powell at the press conference following the Federal Open Market Committee’s October meeting.

Even with a masters degree and a decade of experience, it took Ballard seven months to secure a new job. Today, she’s using her steady income to repay her credit card balance by next year and put money back into her 401(k). She was also finally able to furnish her home.

Know your options for paying your mortgage without income

If you’re in a similar situation, it’s important to know your options. Mortgage servicers have tools to keep you in the home and keep you paying your mortgage. Here are some examples:

- Repayment plan: If you fall behind on your mortgage payments, your mortgage servicer can help you by creating a repayment plan to catch back up.

- Mortgage forbearance: Forbearance means putting your loan on hold. You’ll still pay interest, but your monthly payment will be lower. How long the forbearance lasts depends on your finances and your mortgage servicer.

- Loan modification: A loan modification adjusts your mortgage rate and/or mortgage term to make it more affordable. If you’ve suffered additional hardship along with losing your job — such as a natural disaster or a significant rise in housing costs — you may qualify for a loan modification.

Aside from what your servicer can offer you, there are other actions you can take to help you manage your expenses:

- Lowering other housing expenses: Shopping around for a new home insurance policy and talking to your utility companies about your situation could help you lower your homeownership costs.

- Seek help from a nonprofit: Nonprofit debt counselors can act as a go-between between you and your mortgage company, helping you make the case for financial assistance. They also have the expertise to help you manage your other expenses.

- Contact your state housing agency: State housing agencies may be aware of available assistance programs for your specific area. For example, Pennsylvania offers the Homeowners Emergency Mortgage Assistance Program (HEMAP).

One homeowner is still on the job hunt 9 months later

For Symone Austin, 33 years old, working with her mortgage servicer didn’t lead to any relief — so she’s had to make it work on her own. She’s been unemployed since getting laid off in early 2025 from her six-figure job as a UX content designer.

To learn about payment options on the North Carolina home she bought last year, she called her mortgage lender after the layoff. But the advice was discouraging — she was told she’d have to miss a payment before she could get help.

“It felt like I needed to be actively drowning before they would provide a life jacket,” she says.

Austin filed for unemployment and got her student loans deferred for 6 months, which are now due again. She earns some income making YouTube videos about personal finance and budgeting (“Life and Numbers”), which she puts toward her mortgage payments.

By shopping at more affordable stores and not splurging on makeup or name brands, she’s trying not to add to her credit card debt, which she moved to a balance transfer card to stop accruing interest until April 2026.

Austin says the job search has been discouraging. “With everyone trying to find a job at the same time, it’s really competitive now,” she explains. After we spoke, she was headed to AfroTech, a conference for Black professionals, to network.

Even though she’s been able to pay her mortgage and stay in her home, it’s an anxious season for Austin. “I feel like my brain has been rewired over the past year.”

Why we ask for feedback

Your feedback helps us improve our content and services. It takes less than a minute to

complete.

Your responses are anonymous and will only be used for improving our website.

Help us improve our content

Read the full article here