Image by PM Images/Getty Images; Illustration by Hunter Newton/Bankrate Mortgage rates reversed course to edge lower this week, with the 30-year fixed rate averaging 6.29%, down from 6.31% the previous week, according to Bankrate’s latest lender survey. Current mortgage rates Loan type Current 4 weeks ago One year ago 52-week…

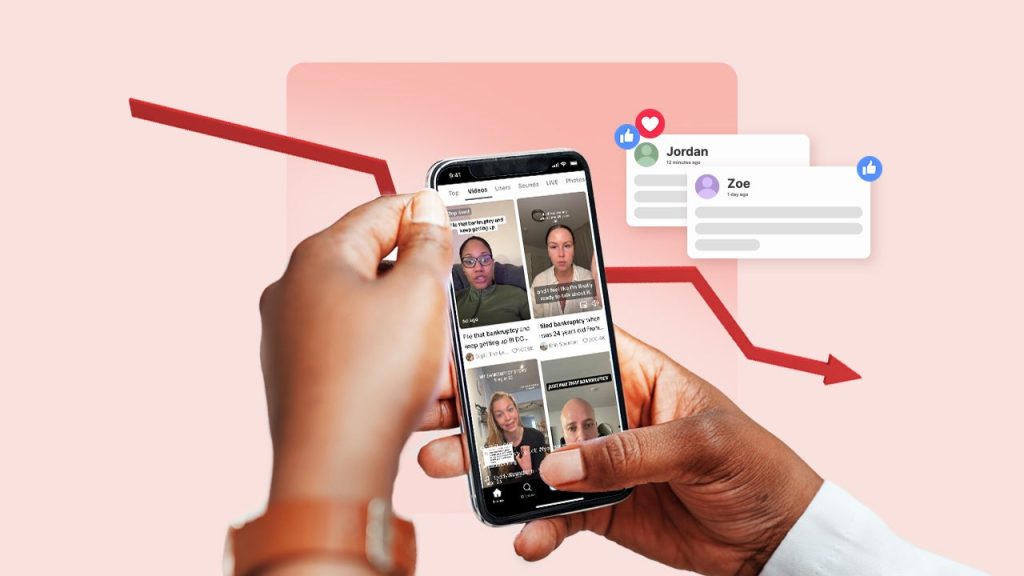

The job market shouldn’t feel as broken as it does right now – and the data backs that up. The U.S. economy grew by the fastest pace in nearly two years last quarter, the stock market is on a tear and unemployment is still relatively low. Usually, that should mean…

Shock. Anger. Shame. And finally, hopelessness. The emotions that follow a car repossession can be overwhelming, but they often converge into one lingering question: “What do I do now?” As an insurance agent in 2009, I received this call more times than I can count, as the Great Recession resulted…

Selena Cooper, 25, is a federal worker in South Carolina. After the government shut down on Oct. 1, the office where she works was closed, and her paychecks stopped coming through. It didn’t take long before she found herself with an overdraft balance on her checking account and $4,000 in…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Key takeaways CDs earning 4% APY provide guaranteed returns with FDIC insurance up to $250,000 — making them one of the safest investments available. A $10,000 CD at 4% APY earns $400 in one year, while a 5-year CD at 4% APY generates $2,166 in…

Dept Managmnt

Practical Money Tricks That Lead to Real Treats Getting out of debt doesn’t happen overnight, but small, consistent actions can help you regain…

Banking

The fundamental flaws in the way the Federal Reserve operates these days were on full display Wednesday when Jerome Powell talked to the…

Credit Cards

All News

When the Federal Reserve cuts interest rates even by just 0.25%, it will have a direct impact on your finances. While a quarter of a percent may sound small, even slight changes in rates can ripple through the economy affecting everything from credit card payments to mortgage rates (more on…

For the first time in nine months, the Federal Reserve looks ready to cut interest rates. It might not be the cure to painfully high borrowing costs that many Americans have been waiting for. Policymakers are expected to trim their key borrowing rate by a quarter of a percentage point…

FG Trade/GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways Federal law requires mortgage lenders to automatically cancel private mortgage insurance (PMI) when the mortgage balance drops to 78 percent of the home’s purchase price, or when the loan term reaches its halfway point, whichever comes first. You can also ask for…

Key takeaways Your starting credit score depends on your initial credit activity; there is no standard starting point. You need at least one open account with one to six months of activity reported to receive a FICO score or VantageScore. Building healthy credit habits early on will help you start…

Life throws curveballs. And often those curveballs mean you’re spending your hard-earned savings or you’re borrowing money instead. It can feel like a catch-22: Creating savings should help you avoid costly borrowing, but spending it equals losing it and going back to square one. So what is a saver to…

Planning for retirement often comes with questions about when and how you can tap into your savings. One such question many people ask is, “Can I withdraw from my 457 while still employed?” Unlike other retirement accounts, 457 plans (also known as 457(b) plans) have their specific rules and exceptions…

We’re heading into the final months of the year, which makes this the ideal time to lower your 2025 tax bill. Financial moves you make before year-end can reduce your taxable income, trim what you owe the IRS and put more money back in your pocket come tax-filing season. Here…

How long it takes to get a 401(k) loan can vary depending on your employer, plan administrator and whether your plan offers an online portal or requires paperwork. In some cases, the process may take just a few days. In others, you may need to wait a couple of weeks…

Key takeaways The Delta SkyMiles® Gold American Express Card is a solid option for frequent Delta customers, but the $150 annual fee (waived the first year) might be a bit steep for some. This card earns 2X miles at U.S. supermarkets, at restaurants (including takeout and delivery in the U.S.)…

If we have long been guilty of over-borrowing student loans for college, perhaps part of the solution is using a different — but similar — private financial product. Annual student loan borrowing has tripled since the 1990s And yet, average net tuition has increased by only 46 percent over the…

Editor's Pick