Images by GettyImages; Illustration by Hunter Newton/Bankrate Key takeaways When you prepay your mortgage, you pay extra toward the loan principal. This helps you pay your loan off sooner and save money on interest. There are many ways to prepay a mortgage, including through biweekly payments, periodic extra payments or…

While the top ten largest credit unions still hold significantly less in assets than even the top five largest banks, they have been growing considerably in recent years. Just within 5 ½ years, total assets in federally insured credit unions have risen by over 46%, increasing from $1.64 trillion in…

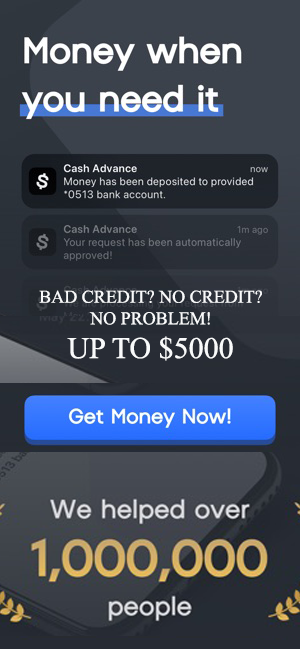

Images by GettyImages; Illustration by Jessa Lizama/Bankrate Key takeaways Lower credit scores signal higher risk of default to lenders, so lenders will limit loan amounts. Borrowers with bad credit get approved for unsecured loans with an average amount under $2,000, according to TransUnion data. Adding a cosigner or co-borrower with…

While adding a child to a deed may seem straightforward, the tax implications can be complex and long-lasting. Depending on how you structure the transfer, it may affect gift taxes, capital gains taxes, and future estate planning outcomes. State laws and ownership structures can also influence the results. A financial…

Spotlight This Week

More ArticlesPersonal Finance

Last year, on the day before Tax Day, my mom was scheduled to fly into Philadelphia International Airport to stay…

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

With Republicans ending the Grad Plus program, private lenders are eyeing billions in new business, while some students could be…

Featured Articles

Once you retire, the purpose of your investment portfolio often changes. Instead of concentrating primarily on growth, many retirees focus on generating reliable income to supplement Social Security, pensions or other sources of income. Choosing the right investments to add income after retiring can help…

Dept Managmnt

Does a Consumer Proposal Affect My Credit Score? Yes, filing a consumer proposal will affect your credit score. Your score reflects your past…

Banking

These entrepreneurs, traders and investors are making an outsized impact in fintech, crypto and traditional financial services.By Jeff Kauflin, Hank Tucker and Nina…

Credit Cards

All News

To identify the best lenders for mortgage refinances, Bankrate analyzed Home Mortgage Disclosure Act (HMDA) data to determine the amount of lenders’ mortgage volume that was made up of refinance mortgages in 2024, the most recent year for which data is available. At least 20% of a lender’s mortgages must…

Receiving a tax refund can feel like a sudden financial windfall, an opportunity to breathe easier and recalibrate your budget. While it is tempting to view this check as “extra” money, it is actually a strategic tool. When used wisely, this influx of cash can significantly enhance your long-term financial…

Key takeaways A home equity loan allows you to borrow a lump sum against your home’s equity, usually at a fixed interest rate that’s lower than other forms of consumer debt. The amount you can borrow with a home equity loan is based on the current market value of your…

Halfpoint Images/Getty Images Key takeaways High-yield savings accounts and money market funds both provide safe places to park your cash, and are ideal for short-term savings. But neither will generate significant long-term wealth or outpace investments like stocks. Money market funds are investment accounts that potentially could lose money, though…

Key takeaways Mortgage loan amortization refers to how you repay your mortgage balance over the loan term. At the beginning of your loan term, more of your payment goes toward interest, but this reverses closer to the end of the term. You can use your amortization schedule to find the…

The Standard & Poor’s 500 index, or S&P 500, is perhaps the world’s most well-known stock index. The index contains 500 of the largest publicly traded companies in the U.S., making it a bellwether for stocks. It includes stocks across all 11 sectors of the economy, as defined by the…

Key takeaways Low-cost index mutual funds and exchange-traded funds (ETFs) are a great way to invest in the market, giving you a diversified fund with low expenses. Index funds are passive funds that track an established index, making changes only when the index itself changes, rather than actively trying to…

bernardbodo/ Getty Images; Illustration by Austin Courregé/Bankrate Saving and investing are both important for building a sound financial foundation, but they’re not the same thing. It’s important to know the differences, and when it’s best to save vs. when it’s best to invest. The biggest difference between saving and investing…

Being midway to retirement means you may still have years of earnings ahead. However, the margin for error is smaller than it was earlier in your career. Choosing investments typically involves balancing continued growth with a growing emphasis on risk management and future income. At this stage, you want to…

At 10 years before retirement, investment priorities often begin to shift. The focus typically moves from maximizing growth to protecting accumulated savings while managing risk and preparing for future income. Portfolios at this stage commonly combine growth-oriented assets with stabilizing investments to help limit volatility and support a smoother transition…

Editor's Pick