Image by PM Images/Getty Images; Illustration by Hunter Newton/Bankrate Mortgage rates reversed course to edge lower this week, with the 30-year fixed rate averaging 6.29%, down from 6.31% the previous week, according to Bankrate’s latest lender survey. Current mortgage rates Loan type Current 4 weeks ago One year ago 52-week…

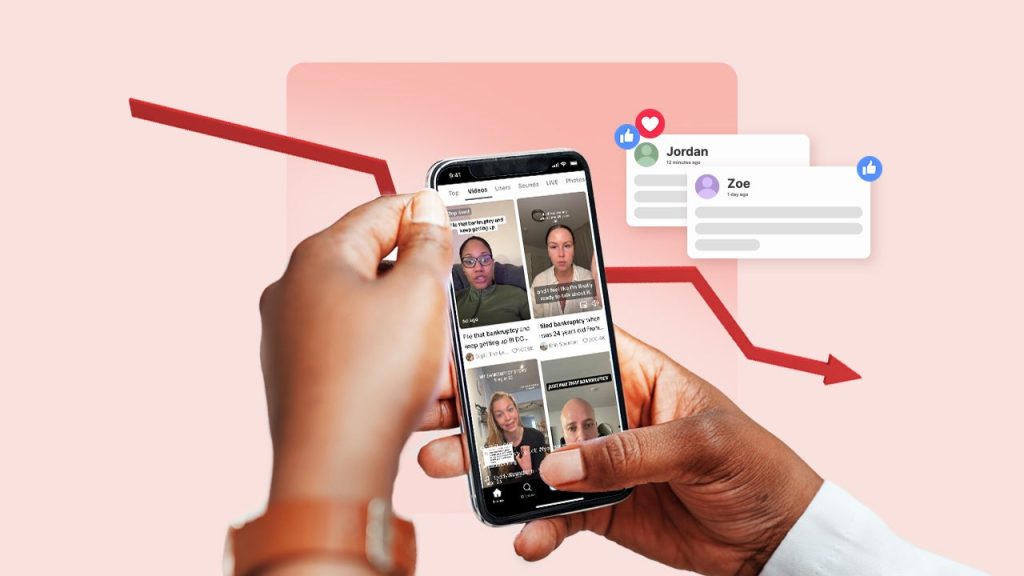

The job market shouldn’t feel as broken as it does right now – and the data backs that up. The U.S. economy grew by the fastest pace in nearly two years last quarter, the stock market is on a tear and unemployment is still relatively low. Usually, that should mean…

Shock. Anger. Shame. And finally, hopelessness. The emotions that follow a car repossession can be overwhelming, but they often converge into one lingering question: “What do I do now?” As an insurance agent in 2009, I received this call more times than I can count, as the Great Recession resulted…

Selena Cooper, 25, is a federal worker in South Carolina. After the government shut down on Oct. 1, the office where she works was closed, and her paychecks stopped coming through. It didn’t take long before she found herself with an overdraft balance on her checking account and $4,000 in…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Key takeaways CDs earning 4% APY provide guaranteed returns with FDIC insurance up to $250,000 — making them one of the safest investments available. A $10,000 CD at 4% APY earns $400 in one year, while a 5-year CD at 4% APY generates $2,166 in…

Dept Managmnt

Practical Money Tricks That Lead to Real Treats Getting out of debt doesn’t happen overnight, but small, consistent actions can help you regain…

Banking

The fundamental flaws in the way the Federal Reserve operates these days were on full display Wednesday when Jerome Powell talked to the…

Credit Cards

All News

Gold hit an all-time high this week, reaching $3,819 per ounce — and, for the first time in half a century, topping its 1980 peak in inflation-adjusted terms.The yellow metal is now up 45% this year, making it by far the best-performing asset class of 2025, outpacing Wall Street’s crown…

If there’s one thing everyone agrees on, it’s that housing is unaffordable. Case in point: the National Association of Home Builders said in March that 60% of U.S. households can’t afford a $300,000 home at a time when the median price is now well above $400,000. For most families, the…

Key takeaways Car prices, monthly payments, and insurance costs all rose during 2024. Good credit scores are key to securing good auto loan rates. APRs are decreasing for super prime and prime borrowers but rising for all other borrowers. Consumers should keep an eye on increased overall costs for new…

Wasan Tita/Getty Images: Illustration by Issiah Davis/Bankrate Key takeaways A down payment is the portion of a home’s purchase price the buyer isn’t financing with a mortgage. The amount is paid upfront at closing. Depending on the buyer’s finances and the type of loan, down payments typically range from 3…

As September marks National Preparedness Month, it’s a timely reminder to reassess not only our emergency kits and plans but also the state of our finances. In the face of unpredictable events, financial stability can be as crucial as having the right supplies on hand. Unexpected events like job loss,…

Key takeaways Both the Chase Freedom Rise® and the Discover it® Student Chrome are strong starter credit cards that can help students build credit while earning cash back. The Chase Freedom Rise®, while offering flat-rate rewards, provides long-term benefits such as broader redemption options and potential pathways to premium Chase…

Here’s something credit card experts know but you might not: it’s getting much tougher for the average person to find a great travel credit card that unlocks luxury experiences without the price tag. Major credit card issuers have steadily made premium credit cards more exclusive in recent years. Before, they…

Key takeaways The SIPC is a federally mandated, private nonprofit organization that helps protect securities and cash in brokerage accounts against the risk of the brokerage becoming insolvent. The SIPC protects specific types of securities, such as stocks, bonds (including Treasurys), money market mutual funds and CDs. The SIPC and…

Image by GettyImages; Illustration by Bankrate A sharp pullback in home equity rates, one week after the Fed’s highly anticipated quarter-point rate cut. The $30,000 home equity line of credit tumbled 17 basis points to 7.88 percent, its lowest level in about a year-and-a-half, according to Bankrate’s national survey of…

For the first half of my 20s, I thought about money in the same way you might think about grocery shopping or laundry — a chore, but not requiring more brain space than necessary to get food on the shelves or clean clothes in the closet. As long as there…

Editor's Pick