Image by PM Images/Getty Images; Illustration by Hunter Newton/Bankrate Mortgage rates reversed course to edge lower this week, with the 30-year fixed rate averaging 6.29%, down from 6.31% the previous week, according to Bankrate’s latest lender survey. Current mortgage rates Loan type Current 4 weeks ago One year ago 52-week…

The job market shouldn’t feel as broken as it does right now – and the data backs that up. The U.S. economy grew by the fastest pace in nearly two years last quarter, the stock market is on a tear and unemployment is still relatively low. Usually, that should mean…

Shock. Anger. Shame. And finally, hopelessness. The emotions that follow a car repossession can be overwhelming, but they often converge into one lingering question: “What do I do now?” As an insurance agent in 2009, I received this call more times than I can count, as the Great Recession resulted…

Selena Cooper, 25, is a federal worker in South Carolina. After the government shut down on Oct. 1, the office where she works was closed, and her paychecks stopped coming through. It didn’t take long before she found herself with an overdraft balance on her checking account and $4,000 in…

Personal Finance

The nation’s 75 million Social Security recipients will receive a 2.8% cost of living adjustment (COLA) increase in their benefits…

Historically Black colleges and universities are on the frontlines of the One Big Beautiful Bill Act’s new limits on parent…

The big new fees JPMorgan Chase is planning to charge some financial technology companies may well trickle down to consumers,…

With artificial intelligence beginning to eat away at many white-collar entry-level jobs, and the unemployment rate for recent college graduates…

Featured Articles

Key takeaways CDs earning 4% APY provide guaranteed returns with FDIC insurance up to $250,000 — making them one of the safest investments available. A $10,000 CD at 4% APY earns $400 in one year, while a 5-year CD at 4% APY generates $2,166 in…

Dept Managmnt

Practical Money Tricks That Lead to Real Treats Getting out of debt doesn’t happen overnight, but small, consistent actions can help you regain…

Banking

The fundamental flaws in the way the Federal Reserve operates these days were on full display Wednesday when Jerome Powell talked to the…

Credit Cards

All News

Key takeaways Predatory cards are often viewed as a last resort for those with the worst credit scores. These cards are known for sky-high interest rates, lower credit limits and myriad fees. Stronger credit-building options exist, even for those with poor credit. Help is available for those unable to pay…

If you default on a 401(k) loan, the balance is usually treated as a taxable distribution. This may result in income taxes and, if you are under 59½, a 10% early withdrawal penalty. It can also reduce the amount you have available for retirement in the future. A financial advisor…

While some retirement plans allow in-service withdrawals, most discourage early access with penalties, taxes and missed growth potential. Before making a move that could undermine your long-term retirement goals, it helps to know the rules. A financial advisor can help you balance today’s needs with your long-term retirement goals.Can You…

Using a 401(k) loan for home improvement may feel like an easy solution to unexpected expenses. After all, you’re borrowing from yourself. There’s no credit check, and the interest you pay goes back into your retirement account. While the convenience may be appealing, the long-term financial trade-offs deserve your consideration.…

When a parent passes away, one of the biggest financial questions families face is whether their children can receive any of their parent’s pension benefits. Unlike life insurance or retirement accounts, pensions have stricter rules that often limit who can inherit them, and children are rarely at the top of…

Testing Financial Independence – What Have You Got to Lose? Testing financial independence through a “trial run” before committing to a lease helps young adults understand the real cost of living on their own if they’ve never lived without a roommate or outside of the home they grew up in.…

Unlike traditional loans, a 401(k) loan is tied to your employer-sponsored retirement plan. That means your repayment options and timeline may change significantly once you are no longer with the company. If you fail to repay the loan within the specified period, it could be treated as a taxable distribution,…

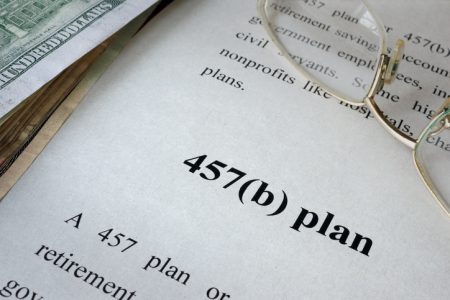

Planning how and when to withdraw money from your retirement accounts can have a big impact on how much of your savings you actually get to keep. This is especially true with 457(b) plans, which are common for public sector employees. While these accounts offer unique flexibility when compared with…

Medicare premiums are based on taxable income and a sudden increase can raise your costs. So if you are considering a Roth conversion as part of a long-term strategy to lower retirement taxes, this could raise your premiums in the year after the conversion. However, you should also note that…

Combining a 401(k) from work with an IRA can help you grow savings faster and give you more options for retirement planning. Contributing to both could grow your retirement savings by combining tax-deferred and tax-free advantages. A 401(k) typically provides employer matching, while an IRA offers wider investment flexibility. Together,…

Editor's Pick