Understand your Debt: Debt from credit cards, loans, or medical bills can feel overwhelming. Recognizing its commonality is the first step in tackling it.

Assess Your Finances: List all debts, including amounts and interest rates. Identify budget areas for cuts, like subscriptions and dining out.

Create a Repayment Plan: Use strategies like the snowball (smallest debts first) or avalanche (highest interest first) methods. Set achievable goals.

Increase Income: Consider freelancing, part-time work, or monetizing hobbies to speed up debt repayment.

Debt Management Plan (DMP): Consolidates debts into a single reduced-interest payment.

Use Resources and Support: Leverage online tools and support networks for guidance and accountability.

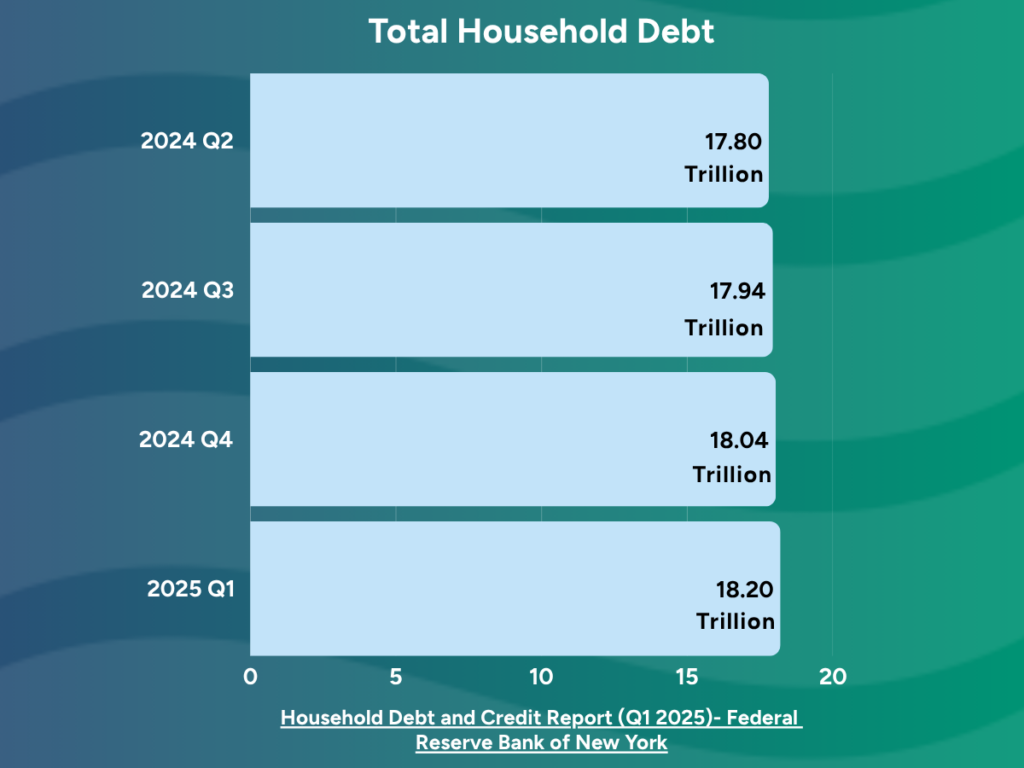

Understanding Debt Challenge. Debt can accumulate from various sources such as credit cards, student loans, or unexpected medical bills. According to a report by the Federal Reserve, American household debt reached $18.20 trillion this year1, highlighting the widespread nature of this issue. With such significant figures, it’s no wonder many individuals feel overwhelmed

Dealing with debt can often feel like an impossible task, leaving many overwhelmed and unsure of where to start. So you’re now asking yourself, I’m trying to deal with debt, but it feels impossible, what should I do? Well, breaking it down into manageable steps and seeking support from financial professionals can make the process much less daunting. In this guide, we’ll explore practical strategies to tackle debt effectively and break down the process below:

Assess Your Financial Situation

Create a Comprehensive List: Begin by listing all debts, including the amount owed, interest rates, and minimum payment amounts. This provides a clear picture of what you’re dealing with and helps prioritize which debts to tackle first.

Analyze Your Budget: Review your income and expenses. Identify areas where you can cut back to free up funds for debt repayment. What are examples of things I could cut? Subscriptions like TV streaming services. Take advantage of free ones. Some libraries even give you access to a streaming service with a library card called Kanopy. Additionally, consider cutting back on dining out by planning meals and cooking at home, which not only saves money but can also be a healthier option. Evaluate your transportation costs—carpooling, using public transportation, or even cycling can significantly reduce expenses.

Develop a Debt Repayment Plan

Focus on One Debt at a Time: Select a debt repayment strategy like the snowball method (paying off the smallest debts first) or the avalanche method (tackling the highest interest rate debts first). Both methods have their merits and can be effective based on your personal preferences.

Set Achievable Goals: Set realistic and specific goals for paying off each debt. For instance, aim to pay an extra $50 on the credit card with the highest interest each month.

Can Additional Income Help Me?

Yes, exploring additional income opportunities can accelerate the process of repaying debt. Consider freelancing or part-time work to supplement your income. Platforms like Upwork or Fiverr offer various freelance opportunities that can be pursued in your spare time. Additionally, think about monetizing your hobbies or skills by turning them into a side hustle. Whether it’s crafting, photography, or tutoring, these activities can be both personally and financially rewarding.

Benefits of Professional Support

Engaging with financial professionals provides personalized strategies and insights that can significantly enhance your debt repayment journey. They offer expertise in negotiating with creditors and can often secure lower interest rates or waived fees. Seeking professional guidance, such as through nonprofit credit counseling services, can be a valuable step. Organizations like American Consumer Credit Counseling (ACCC) offer credit counseling to help you understand your financial situation and develop a personalized plan. ACCC also provides debt management plans (DMP), which will be tailored to your needs.

With their extensive experience, ACCC can help you explore various debt relief options, ensuring that you choose the one that best aligns with your financial goals and circumstances. Engaging with a professional not only alleviates the stress of managing debt on your own but also empowers you with the knowledge and tools needed to make informed decisions. This support creates a structured path to financial freedom, giving you the peace of mind to focus on other life priorities.

Why Should I Consider Professional Support?

- Expert Negotiation: Professionals can negotiate on your behalf to potentially lower interest rates and eliminate fees, reducing the overall cost of debt repayment.

- Tailored Solutions: Counseling services provide customized plans that consider your unique financial situation, ensuring a more effective approach to debt management.

- Stress Reduction: By entrusting professionals with the complexities of debt negotiation and management, you can focus on achieving your financial goals without feeling overwhelmed.

- Educational Resources: Access to workshops and seminars can enhance your financial literacy, equipping you with skills to manage finances more effectively in the future.

- Long-term Benefits: Professional guidance can lead to improved credit scores and financial habits, setting a solid foundation for future financial security.

Engaging with financial professionals can transform the daunting task of debt repayment into a manageable and hopeful journey. With their assistance, you can pave the way toward a debt-free future, secure in the knowledge that expert advice and support are just a click away.

Can a DMP Help Me?

Yes! Enrolling in a debt management program can consolidate your debts into a single monthly payment, often at a reduced interest rate. This approach simplifies your financial obligations and may lead to more manageable repayment terms. By working with professionals and utilizing available resources, you can take proactive steps towards achieving financial stability and reducing debt effectively.

Leveraging Resources and Support

Utilizing online tools and resources, such as online calculators and budgeting apps, can simplify managing your finances and tracking your debt repayment progress. Connecting with a support network by sharing your goals with friends or family can provide encouragement and accountability.

Conclusion

Although dealing with debt may feel like an impossible task, it doesn’t have to be. By assessing your financial situation, prioritizing your debts, and exploring additional income opportunities, you can create a clear and effective repayment roadmap. Don’t overlook the power of professional support; engaging with financial experts can provide tailored strategies, reduce stress, and offer educational resources to empower your financial decisions. Additionally, debt management programs and leveraging online tools can streamline your efforts, making the path to financial freedom more accessible. Remember, with determination, informed strategies, and the right support, overcoming debt is not only possible but can lead to a more secure and financially sound future.

FAQs

1. Why does dealing with debt feel overwhelming?

Debt feels overwhelming due to its complexity and emotional burden. Multiple sources, like credit cards and loans, contribute to the challenge, especially with U.S. household debt at $18.20 trillion.

2. How do I start tackling my debt?

Start by listing all debts, amounts, interest rates, and minimum payments. Analyze your budget to cut expenses, freeing up funds for repayment.

3. What are effective strategies for debt repayment?

Use the snowball method to pay off small debts first or the avalanche method for high-interest debts. Choose what fits your goals and aim to pay extra each month.

4. Can additional income help with debt repayment?

Yes, extra income can speed up repayment. Consider freelancing or part-time work, or monetize hobbies for extra funds.

5. Why should I consider professional financial support?

Professionals can negotiate better terms, create tailored plans, and offer resources, reducing stress and improving financial literacy.

6. What is a Debt Management Program (DMP), and how can it help?

A DMP consolidates debts into one payment, often with lower interest rates, simplifying obligations and aiding financial stability.

7. What resources can help me manage my debt?

Use budgeting apps and debt calculators, and build a support network for encouragement and accountability.

8. Is overcoming debt truly possible?

Read the full article here